Government & Military Satcom: A Work in Progress?

Jan 15th, 2014

by Claude Rousseau, NSR

With the raft of bad news from recent earning calls stating

lower government revenues in the satellite industry, one has to

ask the question: is a pessimistic view of the market fair when

the changes coming will grow the market pie and offer more

bits-per-hertz at a cheaper unit price.

The truth is that pessimistic views overshadow many

opportunities for solutions developed over the past ten years

that address military requirements of lower budgets while at the

same time offering more bandwidth.

The inventor of electricity Thomas Edison once said:

‘Opportunity is missed by most people because it is dressed in

overalls and looks like work’. Well, these new opportunities

for the government and military users are indeed a lot of work

with many still a work-in-progress. But these will not

only change the make-up of the off-the-shelf products available

but also who will jostle for position at the top of this

marketplace.

On top of everyone’s agenda is meeting budget cuts, while at

the same time addressing ballooning requirements for end-users,

and to top it off, on-the-move. With huge steps in

capacity coming online via high-throughput satellites (HTS),

there is some elbowing going on within the industry to meet the

mandate of governments to ‘do more with less’, in particular for

high-potential mobility applications.

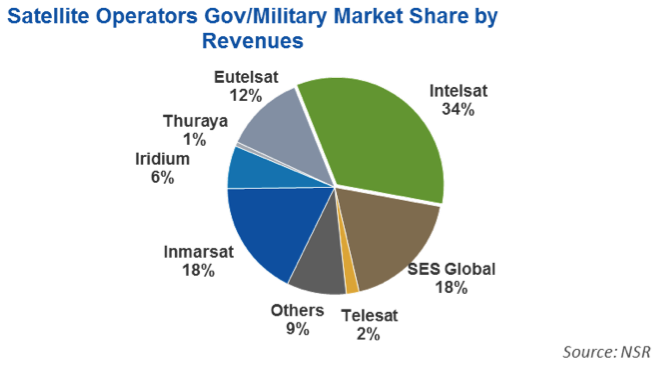

As the graph below shows, when assessing satellite operators

serving this market, the largest portion of the pie is captured

by FSS operators who generated more than 75% of revenues, while

MSS operators take the rest. Intelsat, which expanded its

off-network portfolio (MSS, X-band), has staved off competition

and is far ahead in first, taking in approx. one-third of total

market revenues.

Interesting to note, however, is the two companies that are

just behind in 2nd place. SES, with a video-centric

core and Inmarsat, with a merchant marine base of users, will

likely not only rub shoulders more often in this market but

participate in steering changes to meet the new high-bandwidth,

low-cost challenges of government users. Furthermore,

their market position will likely be determined by how well they

can add more value to users with broadband mobility

requirements.

When looking at this chart, one would say that today Inmarsat

is a strong contender, but it has a lot of room to grow its

government business. In particular, its FSS offering has been

met with far less success than it would have hope for. The

pull-out of troops in the Middle-East, the U.S Navy

decommissioning of its terminals on a couple of hundred ships

and the U.S. Coast Guard’s choice of Ku-Band VSATs for its

Cutter Class vessels’ primary means of communications, instead

of Fleet Broadband, are all misfortunes that the operators has

had to grapple with over the past five years.

For SES, their position as a more diversified operator

worldwide and its investment in the high-throughput market via

O3b Networks has lessened the hit. Several new Ku-band

transponders over oceans are also taking them on the path to

address the market for bandwidth and mobile solutions.

And for Intelsat, keeping its no.1 share also means it must

capitalize on its HTS EPIC satellites and deploy more capacity

over places where ships, airborne platforms and UAVs fly, to

lessen the recent drop in revenues due to transponder price cuts

offered to the U.S. Government.

Having said this, it is easier to see why Inmarsat, which

will be the first out of the gate with a global fleet of

satellites offering high-throughput capacity to government

users, is still targeting this market. A good portion of its

revenue is expected to come from the agreement in place with

Boeing whereby the satellite manufacturer’s take-or-pay of 10%

of the fleet’s capacity aims at getting military users onto the

military Ka-band part of Global Xpress payload. Specifically,

these services will have advantages for troops, ships and

airborne platforms with an ‘almost-like’ WGS connectivity on a

global basis that is becoming a strategic communications

infrastructure for many countries around the globe. And thus,

with this key advantage, Inmarsat is hoping to forge itself a

future expansion in the government FSS business in a market in

dire need of cheaper bits.

Bottom Line

The increased efforts to reduce the cost

of communications links by satellite operators will not only

bring more benefits to government and military users, but also

create a more dynamic market where both FSS and MSS services

will increasingly collide into each other. The work-in-progress

sign is still up on the doors of many satellites operators

targeting the higher bandwidth and mobility government satcom

markets, but the opportunities are likely to be just beyond the

doorway.