5G: Friend or Foe for Satcom?

Jan 17th, 2017 by Lluc Palerm-Serra, NSR

As if we were on the verge of entering a “blade runner” society, 5G will disrupt the way we interact with the world. The new network technology promises a leap change in performance: ultra-fast speeds, lower latency, smarter networks… all setting the ecosystem for extreme business models and unleashing massive opportunities. Will the satellite industry be able to capture a portion of this wealthy opportunity?

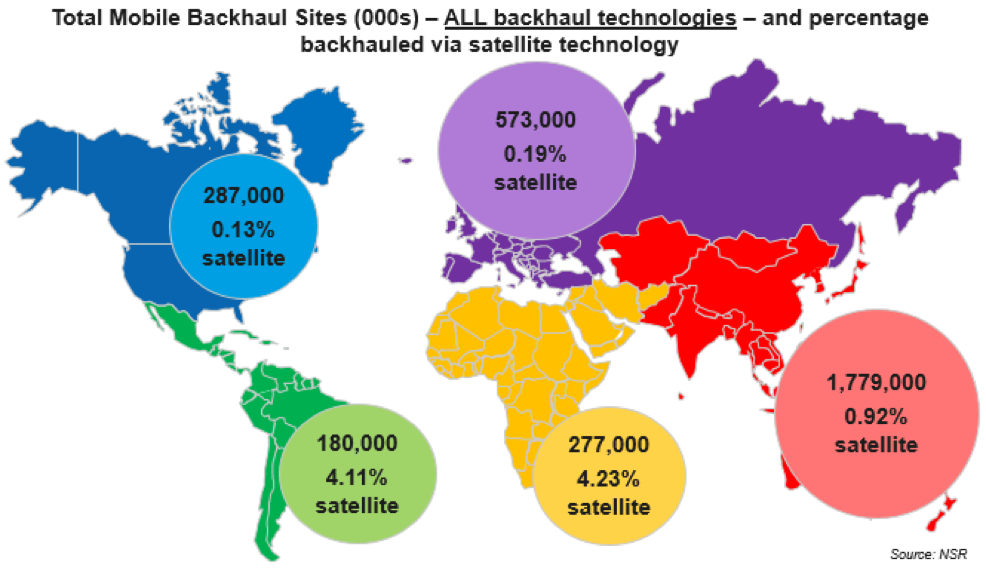

Today’s satellite role in the global telecom ecosystem is relatively modest. According to NSR’s Wireless Backhaul via Satellite, 10th Edition Report, only 1.2% of Global Mobile Backhaul Sites use satellite. Beyond just providing enhanced performances, 5G is about transforming how telecom networks are conceived. How can satcom play a bigger role in the future telecom ecosystem?

The Path to 5G

The business environment that 5G will encounter is very different from previous generations. Gone are the days of explosive subscriber growth. 4G hasn’t still reached its limits and can provide very fast speeds (Sprint aims at 1 Gbps speeds for this year). Data traffic continues to explode and so are costs. MNOs are trying to capitalize on premium plans, but revenue growth is marginal. Value in the mobile ecosystem is migrating from connectivity to content and platforms. In this overall situation, the actual focus on 5G is not in providing “faster networks” as it was in previous generations but in providing cost efficiencies and opening new applications and verticals like IoT, OTT, connected car, eHealth or industrial applications. All in all, 5G is much more than simply adding a new radio access technology, it is about transforming the core network architecture moving capabilities to the edge and virtualizing processes to offer a whole new set of products and services.

There have been a number of announcements for very early deployments of 5G technologies. Both Verizon and AT&T have plans for initial roll-out of commercial services in late 2017 or early 2018. Korea plans to deploy 5G services for 2018’s winter Olympic Games and so does Japan for Tokyo2020. However, these are pre-standard deployments focusing on providing fixed wireless connectivity aimed at reducing the cost of laying out Fiber-To-The-Home networks and with little to lose if eventually do not meet actual standards. The true objective behind these early deployments and trials, beyond the obvious marketing, is to influence the real standard produced by the 3GPP organization to make it as close as possible to each proprietary technology. The actual standard won’t be ready until 2018 and initial deployments are expected for end-2019.

The European Commission expects that by 2020, major cities will have 5G coverage, and it is not until 2025 that all urban areas, major roads and railways should have uninterrupted 5G coverage. Consequently, commercial satellite deployments of 5G sites won’t appear before the 2025 timeline; however, the time to influence the standards to be “satellite friendly” is now. This is a step of major importance to ensure a relevant role for the industry in the future telecom infrastructure.

Can SatCom Meet 5G’s Technology Requirements?

5G comes with what might seem extravagant network performance requirements, and one could even cast a doubt whether satellite technologies would be able to meet those requirements. One particular aspect of the network design worrying the industry is the 1 ms latency requirement. This is an enormous challenge even for ground networks due to the limitations inherited from the speed of light. To meet this requirement, network architecture will need to change dramatically moving a lot of capabilities to the edge. SatCom cannot expect to serve latency ultra-sensitive applications (autonomous car), but the “smart” 5G architecture allows for network slicing serving these use cases from the very edge and still backhauling less latency-sensitive applications through satellite. In any case, satellite backhaul will need to work under 5G protocols, and this might require traffic acceleration and other optimization techniques, something that is already accomplished in today’s networks, but not at such demanding levels so computing capabilities and performance of ground equipment must continue to evolve.

Another key requirement for 5G is peak data rates of minimum 10 Gbps, that together with network densities of 1 Tbps per sq. km will lead to a capacity boom. While the strongest point for satellite technologies is certainly not network density, network densification could open some opportunities for the industry. 5G is programmed to overcome legacy network rigidity automatically and dynamically adapting the core network to traffic requirements. Satellite flexibility is unique, pooling bandwidth for multiple locations offloading peak capacity consumption. Multiple equipment vendors are now offering modems with 100s of Mbps of capacity, while it still runs short to meet 5G demands, technology is progressing very fast and it does not seem unreasonable that ground segment will be ready to meet 5G requirements. Needless to say, availability of satellite capacity at the right price point will be crucial to serve these kind of opportunities.

A New Ecosystem: Capturing 5G Opportunities Today

The transition to 5G goes well beyond just providing enhanced network performance; it targets to transform the whole ecosystem. Some of these changes are starting to take shape today, generating new opportunities that can be capitalized now. Mobile Network Operators are increasingly refocusing efforts in their service offering, with lower interest in managing the infrastructure. This, together with some new emerging trends such as network sharing or infrastructure-as-a-service offerings is creating new opportunities for managed services and end-to-end solutions.

The initial focus for the new generation is enhanced broadband connectivity; however, the long-term vision is to open new markets such as IoT or critical connectivity services. These new markets pose some additional requirements to the network such as ultra-high reliability and ubiquitous coverage. One of the biggest projects for satellite backhaul granted during 2016, the Avanti-Gilat deal with EE in the UK, was based on these two new requirements for networks with a great proportion of sites operating to augment the resiliency of the network and coverage targets based on land area (rather than on population coverage).

With content and capabilities moving to the edge, satcom could potentially efficiently multicast content to massively distributed CDN servers. Despite some aspects still needing to be solved such as seemingly integrating with ground infrastructure or convincing content owners to have their content distributed, this new application is starting to see some demand.

The Never-Ending Battle for Spectrum

One of the most critical aspects of the transition to 5G is the allocation of spectrum. The FCC took the lead and on July 14, 2016 announced the allocation of multiple bands, including Ka, to use 5G networks. While the Commission plans sharing schemes and protection of satellite services, these are now secondary to mobile networks. It is still too early to assess the actual implications of this announcement as the consequences will depend a lot on the implementation of the sharing schemes and the interference mitigation actions. However, in order to protect the interests of the industry, it is more important than ever to demonstrate the value of satellite spectrum for the general interest, being it through provisioning of broadband services to rural locations or as a key instrument to facilitate 5G networks.

Bottom Line

The move to 5G is arguably one of the most transformational steps our society will take in the near future. It will transform the whole telecom ecosystem providing myriad new applications. While the actual implementation is still years away, now is the moment for the satellite industry to ensure it can play a significant role in the ecosystem by influencing “satellite friendly” protocols and demonstrating the key benefits of satellite technologies in deploying more efficient networks. Examples such as the participation of SES in the 5G Infrastructure Association board are key to protect the industry’s interest during this transition.

Some of the performance requirements might seem unattainable for satCom, but 5G actually opens extraordinary opportunities for the satellite industry if technology continues to progress. Ubiquity, resiliency, virtualization or edge capabilities are some of the attributes bringing new opportunities. Satellite has the opportunity to seemingly integrate with ground networks, extending their footprint in the telecom ecosystem.

All in all, 5G presents huge potential business opportunities for the satellite industry; from massive capacity requirements, to ground equipment integrating with mass markets, end-to-end solutions for integrators or new use cases. However, the key question remains if satCom will be able to economically compete for these opportunities when ground alternatives are evolving at such a rapid pace.