In-Flight Connectivity: Two Paths to Success?

Apr 30th, 2015 by

Claude Rousseau, NSR

As in-flight connectivity grows at double-digit rates over the next

decade, the competitive aero environment is

intensifying especially on 2 fronts: throughput and volume.

This entails offering ever more bandwidth per plane and increasing

volume via line-fit of aircraft.

The recent Aircraft Interiors Expo in Hamburg saw in-flight

entertainment and connectivity (IFEC) front and center with many stories

emerging from the show; however, two news items hinted to where the

market is headed in the years ahead: GEE’s connectivity deal with

SouthWest for new B737 MAX, and ViaSat winning accolades from the

industry for providing 12 Mbps per second Wi-Fi service to each

passenger on JetBlue. The former highlights the immediate need for

factory-approved installation of satellite equipment on narrowbody

aircraft, and the latter shows how advanced HTS satellite capacity is

slowly but surely making an impact on the market.

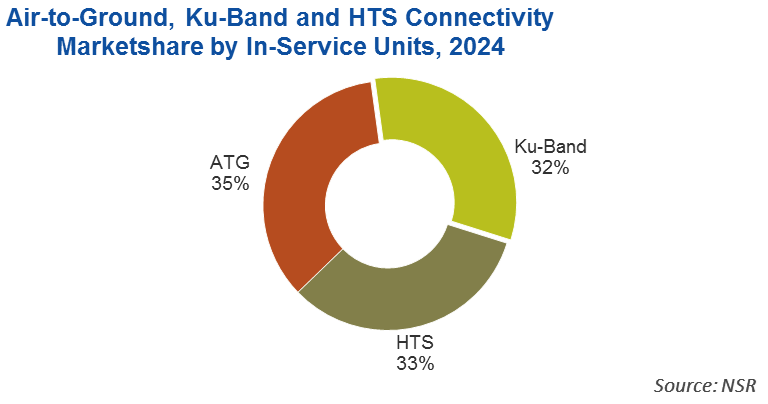

In NSR’s recently released Aeronautical Satcom Markets, 3rd

Edition report, it was noted that with high-throughput satellites (HTS)

connectivity coming online, such as that offered by ViaSat and Intelsat

EPIC, lower-data rate services such as air-to-ground (ATG) will have

less appeal to fulfill the growing passenger demand for bandwidth.

NSR’s take-rate analysis showed that a higher percentage of passengers

use Ku-band service than ATG, with 7.2% compared to 6.7%, respectively.

And when GEO-HTS service is available and “free”, as is the case for

JetBlue aircraft, usage is simply off the charts at 40%. In a

nutshell, HTS connectivity has a much higher take-up rate than FSS

Ku-band service, which has a greater percentage of users on a per

aircraft basis than ATG. A correction downwards would certainly occur if

passengers took the paying ‘Premium’ service offered by JetBlue instead,

but the fact that all major service providers such as Panasonic, GEE and

GoGo entered into HTS capacity deals to meet growing bandwidth demand

from passenger airlines shows the trend clearly.

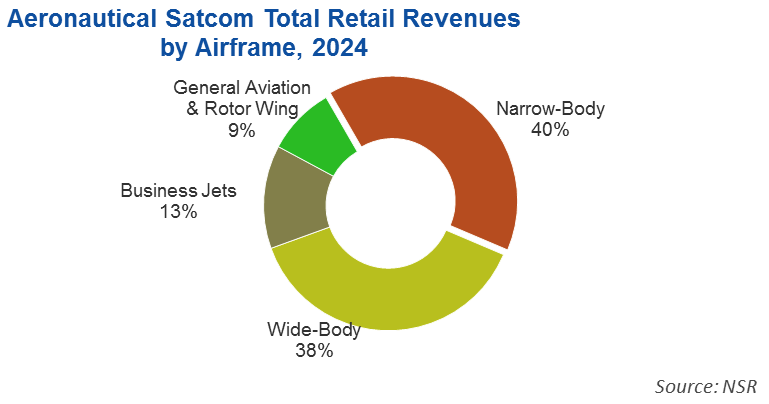

For GEE, the deal with SouthWest hinges on line-fitting Boeing 737s

aircraft with its connectivity solution, for which it has yet to gain

approval from the FAA. Narrowbody aircraft such as the B737s will

represent more than 72% of all Boeing and Airbus planes deliveries in

the next twenty years; in the neighborhood of 47,700 new aircraft.

It’s easy to see why GEE would want to tap into this huge market

and equip planes before they hit the tarmac. And it is

exactly what GEE hopes to do in time for the first SouthWest B737s MAX

that will launch in 2017 under a contract that NSR estimates could see

390 aircraft outfitted (if all options are exercised). The narrowbody

market is the commercial passenger aircrafts’ volume business where GEE

currently leads by far, but it will be a battleground where Panasonic

and others will also fight for a bigger piece of the pie.

Bottom Line

On one hand, offering HTS capacity to provide more bandwidth to meet

passenger connectivity demand is one track that is seeing more ‘traffic’

as the satellite-based IFC market grows. Similarly, service providers

offering line-fit IFC equipment on single-aisle aircraft are a fast

track to grow volume and increase market share. These two

tracks will likely be the right paths to take for success in the IFC

market.

| |